Hong Kong does not have any specific laws governing offshore company registration. The advantages of registering an offshore company are low taxation, no foreign exchange controls, and political and economic stability in the place where the offshore company is registered. Therefore, setting up an offshore company in Hong Kong is the perfect tool for international trade, investment activities and asset protection.

Some countries and regions have formulated some particularly relaxed policies to attract investors from all over the world to set up offshore companies in that country or region ( such as British Virgin Islands (BVI) offshore companies, Seychelles offshore companies, Cayman Islands offshore company, Samoa offshore company, Labuan offshore company, United States Deva offshore company, etc.) . This type of offshore company basically does not levy any taxes, only annual license fees, and can be listed in other countries or regions. It is the first choice for most multinational companies to arrange corporate structure and reorganization.

Compared with ordinary limited companies, the main difference between offshore company registration and general limited companies is taxation. The offshore income of offshore companies does not need to be levied any tax, and no tax declaration is required, and the offshore company’s shareholder information, equity ratio, income status, etc. All enjoy high confidentiality rights.

1. At least one director is required.

2. There is no upper limit on the number of directors.

3. Directors can be individuals or companies.

4. Directors may be Hong Kong residents or non-Hong Kong residents.

5. Directors can be of any nationality.

6. Directors may be nominated.

1. At least one shareholder is required.

2. A maximum of 50 shareholders are allowed.

3. Shareholders can be individuals or companies.

4. Shareholders can be Hong Kong residents or non-Hong Kong residents.

5. Shareholders can be of any nationality.

6. Shareholders can be nominated.

7. 100% local or foreign equity allowed.

8. A sole director may serve as a shareholder.

The registered address of a Hong Kong company requires a local physical address other than a post office box.

Any amount of equity must be injected into the company’s bank account. No holder equity is allowed

Only income “sourced or arising in Hong Kong” is subject to the 16.5% corporate tax rate. Overseas income or foreign income is exempt from Hong Kong tax.

Other documents required by the Registrar of Companies.

Register at the tax bureau: Within one month of registering an offshore company, you must register with the tax bureau and obtain a business registration certificate.

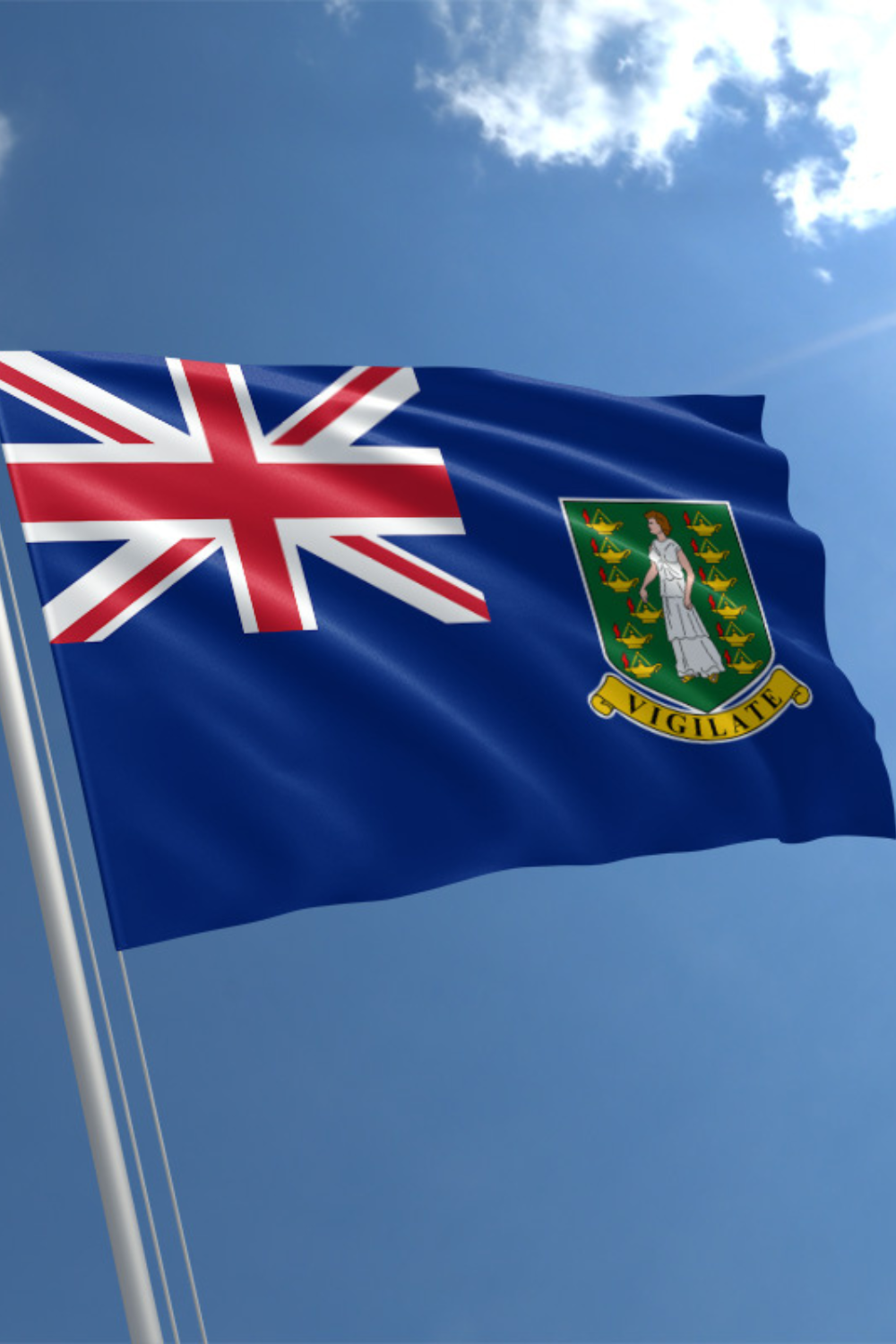

The British Virgin Islands (BVI) is a group of about 40 islands in the Caribbean Sea located approximately 80 kilometers east of Puerto Rico. The BVI is a British Dependent Territory which became self-governing in 1967 and is a member of the British Commonwealth. Since introducing its International Business Company (IBC) legislation in 1984, the BVI offshore financial services sector has developed, and is now the world’s most popular offshore center with around 700,000 companies incorporated. The newly enacted IBC Act should further enhance the jurisdictions popularity.

To register for BVI Limited Company, you need to be prepared as follows

The Cayman Islands are a British colony situated in the Caribbean Sea approximately 500 miles South of Miami, Florida, with a population of approximately 50,000 people of mixed origin. The Islands enjoy sophisticated legal, accounting and banking services and derive political stability by virtue of their connection with Britain. The legal system is British and the government is headed by a Governor appointed by the Crown who presides over a Government made up of twelve locally elected members and three senior civil servants who hold ex-officio office. There is no exchange control and no restrictions on the movement of funds to or from the Islands.

A photocopy of identity card or passport of each director and shareholder;

Residential addresses with proof of all directors and shareholders, such as utility bill, telephone bill;

Proposed name of the company;

Amount of share capital (unless otherwise advised, all company will be incorporated with a standard share capital of USD 50,000 and the percentage of shareholding by each shareholder, if more than one shareholder.

General description as to the proposed activities of the Company (business plan if the company is to be actively trading), to include adequate information/support documentation to substantiate the source of any funds to be held by the Company.

A brief introduction to the client or clients involved so that we can satisfy ourselves that the activities in the Company are in line with the general profile of such person or persons, including commentary as to the source of funds to be invested through the Company.